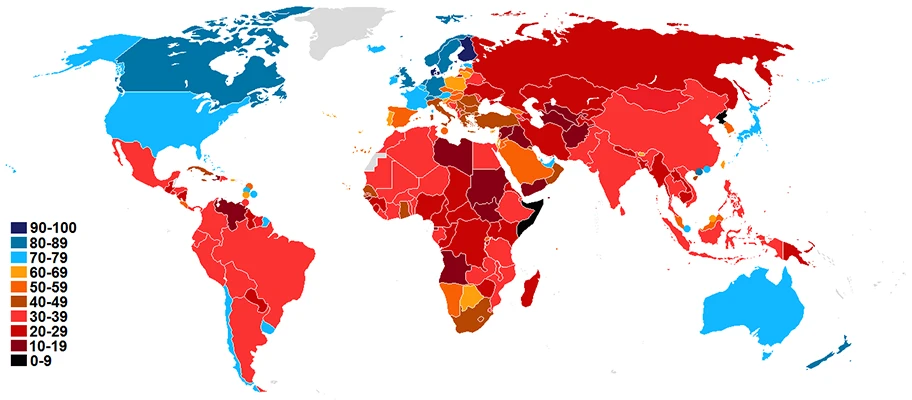

The best-known instrument for measuring corruption is Transparency International's (TI) Corruption Perceptions Index. The index does not measure corruption directly, but rather compiles people's perception of corruption within a country. The index is problematic in two ways:

- It defines corruption as the bribability of public officials and politicians, thus neglecting corrupt practices within the private sector. - It does not rely on a survey of a country's people, but basically uses information provided by business people and so-called country experts.

The people surveyed share views and information among one another, however, and they tend to adopt the perceptions of their peers. This is especially so if they have little personal experience of the country in question. Such feed-back loops can boost the perception of corruption in unjustified ways. Moreover, media coverage of corruption can similarly inflate the perception of corruption in African countries or Brazil for example. The index is, therefore, a topic of debate within TI itself.

It matters that the international dimension of corruption does not get adequate attention, even though corruption is often driven by western structures. The implications of the corrupt behaviour of international corporations must not be underestimated. African states lose more money due to tax avoidance by international corporations than they receive as development aid.

The UN Economic Commission for Africa estimates that illegal financial flows cost Africa around $ 50 billion per year. If one takes OECD estimates as a basis, more than $ 30 billion (or two thirds) stems from “commercial transactions”, including tax avoidance and tax evasion. Only an estimated 2 to 3 billion dollars result from corruption in the sense of officials' bribability, as assessed in TI's Corruption Perceptions Index.

Tax havens facilitate the large outflow of potential tax revenues, and they are by no means limited to the Caribbean and Switzerland. According to the Tax Justice Network's Financial Secrecy Index, the USA ranks third, Germany eighth, Japan 12th and Britain 15th. A global network of “safe havens” has evolved for the capital of international corporations and corrupt politicians.

Bribery by foreign companies

A recent UN report sheds light on cases of cross-border corruption in Africa. In 99.5% the cases involved non-African firms. This means that African companies active in neighbouring countries are not the main culprits who pay bribes to “host” governments. Mostly multinational corporations do so. It is true, however, that the report only examined cross-border corruption, making no assertions concerning domestically paid bribes.Nonetheless, the report does expose another deficiency of the TI Index. It does not include the predominantly international financial actors that pay bribes, but only focuses on the public officials and politicians who accept them. This one-sidedness makes “the Africans” appear more corrupt than multinational corporations even though the corporate money is what drives corruption in the first place.