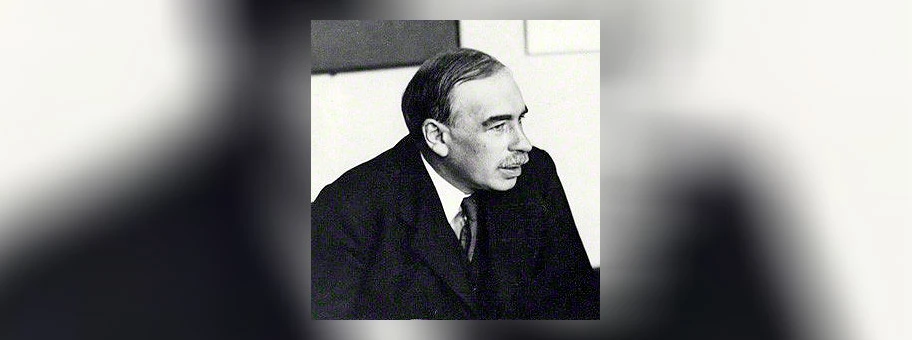

After the bursting of the transatlantic housing bubble in 2008 or the pandemic-induced slump in 2020, everyone was suddenly talking about John Maynard Keynes, who, as the court economist of the old statist social democracy, had advocated an active role for the state in investment programs and monetary policy. Until, after the usual wear and tear in the media circus, nobody talked about him anymore and capitalism seemed to return to “business as usual” after the “Keynesian” stabilization phase.

All that was left were the Keynesians, who had been pushed out of the political and academic mainstream in the neoliberal age and were constantly whining, and with whom the left beyond social democracy now had to contend. But the constant lament from the spectrum of neo-Keynesians and Modern Monetary “Theory” (MMT) that more Keynesianism is needed to make everything better again and for late capitalism to return to the era of the economic miracle is, to put it mildly, misplaced in the face of political realities. Many of the tools of Keynesianism continue to be used in crisis management, but they are not discussed or perceived as such. Keynes has long been a pragmatic part of everyday crisis management, and many of the crisis measures and programs that have stabilized the system since 2008 bear his signature.

And this is only logical against the background of the historical genesis of this school of economics: Keynesianism found its way into the capitalist mainstream after the end of the Second World War precisely as the great “lesson” from the crisis phase that began in 1929 – and in times of crisis the capitalist functional elites almost reflexively resort to its instruments. Consistent regulation of the currency and financial markets, the state as an economic regulatory and steering agent pursuing an active investment policy, a demand-oriented wage and social policy, in which the wage earners of the economic miracle were also understood as consumers, and a counter-cyclical economic policy – these were the now idealized features of the Keynesian economic order until the rise of neoliberalism under Thatcher and Reagan, to which the neo-Keynesians want to return.

It Doesn't Get Cheaper Than This

The pragmatic recourse to the instruments of Keynesianism finds its clearest expression in all the economic stimulus programs that were launched in the wake of the intensifying episodes of crisis. As a result of this increasing intensity, these government subsidy and investment packages have grown in size with each new wave of crisis,[3] as the notorious management consultancy McKinsey demonstrated with reference to the global financial crisis of 2008/09 and the pandemic of 2020.[4] By mid-2020, global government spending to mitigate the effects of the pandemic-generated crisis surge had already reached around $10 trillion – three times the amount of the 2008/09 crisis programs.And it was precisely the German government, which was cautious in its economic policy in 2008 and only made negative headlines at the time with the infamous (and disastrous in terms of climate policy) car scrappage program, that launched particularly far-reaching crisis programs in 2020. In relation to Germany's GDP, Berlin even launched the largest economic stimulus package of all Western industrialized countries: it amounted to 33 percent of GDP. In addition, the Merkel government also initiated a gradual shift away from the pernicious austerity regime in the “German” eurozone by agreeing to a European economic stimulus program in mid-2020 as part of the European budget, which, with a volume of 750 billion, nevertheless includes 380 billion euros of aid payments to the periphery.[5]

And in terms of monetary policy, both the European Central Bank (ECB) and the Federal Reserve (Fed) have, until recently, followed the “it doesn't get cheaper than this” approach. Key interest rates in all Western currency areas have tended to fall further and further in the 21st century. Between 2009 and 2021, a zero interest rate policy prevailed – with brief interruptions – to support the economy and the financial sector. In addition, after the bursting of the transatlantic real estate bubble, the central banks resorted to pure money printing, first by buying mortgage securities and later increasingly by buying government bonds– injecting additional liquidity into the financial sphere and leading to securities price inflation in the context of the great liquidity bubble that burst in 2020. Over the course of the 21st century, the Fed and the ECB have increased their balance sheets almost tenfold, becoming the dumping grounds of the late-capitalist financial system, doomed to perpetual boom, and the largest holders of their sovereigns' debt instruments.

Hyperactive Central Bank Capitalism

The central banks have thus become key economic actors in the course of the crisis process, since without their intervention both the financial sphere and government financing would have collapsed. One could speak of central bank capitalism, as the political economist Joscha Wullweber does in a book of the same title, which highlights the dependence of one part of the financial sphere, the largely unregulated market for repurchase agreements (repos), on central banks' money printing.[6] The current attempt by the ECB and the Fed, in the face of double-digit inflation rates (only the Bank of Japan is desperately bucking the trend),[7] to curb inflation, which has multiple causes (the pandemic, war, the bursting of the liquidity bubble, the climate crisis), by resorting to restrictive monetary policy is not working,[8] but does not necessarily go hand in hand with an end to government bond purchases.In the eurozone, the PEPP (Pandemic Emergency Purchase Program), a 1.85 trillion euro program that buys government bonds while raising interest rates (net purchases are to be suspended next March),[9] has been created specifically to stabilize the eurozone, effectively undermining the fight against inflation – and in turn strengthening the economic role of the state, which can continue to finance its budget deficit under the PEPP. In addition, there have been steps toward an active economic policy by the state, especially with regard to the Green New Deal. Neoliberal hardliners[10] are now complaining loudly in the Handelsblatt about the state's efforts to “steer credit” towards the environment, which would be expressed above all in the introduction of the EU taxonomy regulation defining sustainable investments (ironically, investments in natural gas and nuclear power are also considered “sustainable” in this context). Moreover, German Vice-Chancellor Robert Habeck's State Secretary Sven Giegold – an Attac activist from the very beginning – already spoke out a year ago in the Financial Times (FT) in favor of an “active industrial policy” by Berlin, which should “support innovations” in order to transform the FRG into an “ecological and social market economy.”[11]

However, this structure of crisis capitalism, characterized by increasing state activity, is not the result of a coherent strategy, but an expression of the respective efforts to prevent a collapse of the world economy during the acute episodes of crisis. It is a Keynesianism of blind action, in which functional elites acted quasi-reflexively. The emergency programs and policy changes, often introduced as temporary measures, then become permanent in the course of the crisis; they coagulate into new structures and dynamics in latent crisis phases. In the words of then Finance Minister Schäuble, the German government's actions during the global financial crisis in 2009 were “driving on sight.”[12][13] The packages of measures simply build on each other. Habeck's active industrial policy, for example, for which Giegold drummed up support in the FT, has its precursor in the state promotion of “national champions” under his predecessor Peter Altmaier, who also wanted to specifically promote Germany's export industry in the face of increasing crisis competition and informal state subsidies in China and the United States.[14]

This “driving on sight” of the functional elites in manifest times of crisis, in which ever new elements of state-capitalist crisis management are applied in response to waves of crisis, gives this formation all the characteristics of a transitional stage within the late-capitalist unfolding of crisis. The economic and ecological crises that force politicians to adopt crisis Keynesianism are not the expression of a “wrong” economic policy, but of the escalating internal and external contradictions of the capital relation, which manifest themselves quite concretely in constantly rising debts (faster than world economic output) and an incessantly rising CO2 concentration.

Due to the ever increasing global level of productivity, the world system is, in fact, increasingly running on credit, unable to develop a new leading industrial sector, a new regime of accumulation in which masses of wage labor would be valorized. Through money printing and deficit spending, the state is increasingly acting as a last resort to postpone the crisis, now that deficit accumulation in the context of the neoliberal financial bubble economy (dot-com bubble, real estate bubble, liquidity bubble) has largely exhausted itself in the hot financial markets. For example, the broad-based U.S. stock index S&P 500 has now fallen about a thousand points after reaching its historic high of more than 4700 points at the end of 2021.

Modern Monetary Ideology

The late phase of globalized financial bubble capitalism, in which central banks' expansionary monetary policies contributed to the inflation of securities prices in the financial sphere – to the point of swarm investing and the fleeting booms of meme stocks like GameStop[15] – also gave rise to an extreme form of late- and post-Keynesian economic ideology, which, ignoring any systemic crisis analysis, especially the connection between bubble formation and central banks' monetary open floodgates, could claim that all of the economic and social problems of late capitalism could be solved by printing money. After all, interest rates and inflation remained low between 2008 and 2020.Modern Monetary Theory (MMT) seemed to have succeeded in squaring the capitalist circle. Full employment, the welfare state, economic growth and ecological turnaround are only a matter of expansionary monetary policy, according to the central thesis of MMT. According to this neo-Keynesian monetary theory, which is very popular on the socialist left in the United States, governments that control their currency can freely increase government spending without worrying about deficits. This is because they can always print enough money to pay off their national debt in their currency. According to this theory, inflation is not a problem as long as the economy does not reach its natural growth limits or there is unused economic capacity, such as unemployment.

Printing money until full employment – that is the goal of this late Keynesian demand-driven economic ideology, born in the wake of the financialization of capitalism that it failed to understand. Most proponents of MMT point to the expansionary monetary policy of the U.S. Federal Reserve, which pumped trillions of dollars into the faltering financial markets from 2007 to 2009 and from 2020 onward. Since the money printing known as “quantitative easing” apparently did not result in any surge in inflation, MMT wants to elevate these crisis measures to the guiding principle of neo-social democratic economic policy. An expansive monetary policy is supposed to increase the supply of money as a commodity until demand is satisfied, unemployment has disappeared and the economy is humming along. The historically unprecedented purchasing programs of the central banks, with which a late capitalism running on credit is painstakingly stabilized, are ultimately to be declared the new normality by MMT – and thus become an ideology, a justification of the existing.

It is also no coincidence that MMT has its political home in the U.S., which controls the world's reserve currency, the U.S. dollar. This allows Washington to borrow in the global value measure of all commodities. What it looks like when peripheral countries, which find their global measure of value in the U.S. dollar, start printing their own currencies at will can currently be studied, for example, in the Turkey of the “interest rate critic” Erdogen, where the inflation rate threatens to accelerate into triple digits.[16] MMT is thus not only a very exclusive ideology that may still find supporters in the eurozone, but it is simply disgraced by the experiences in the periphery and semi-periphery.

Thus, neo-Keynesianism sees the cause of the current capitalist malaise primarily in a lack of money supply. The real cause of the crisis, however, is the lack of a leading economic sector, the lack of a new regime of accumulation that would valorize wage labor on a massive scale. Of course, such a regime will never be re-established due to the high level of global productivity. The irrational end in itself of capital is, after all, its highest possible valorization through the exploitation of wage labor – the only commodity that can produce surplus value as the substance of capital – in commodity production. Keynesian demand policy, on the other hand, pretends that capitalism has already been overcome, as if the satisfaction of needs – and not the unlimited valorization of capital – were the purpose of the capitalist economy. It is the usual Keynesian sleight of hand that simply hides the irrationality of capitalist socialization.

We can clearly observe that since the 1980s, as a rule, when capital accumulation in the real economy sputters, speculative growth in the financial sphere sets in. What MMT ignores here is the connection between quantitative easing and the growth of the bloated late capitalist financial sector. The Fed's money printing (like that of the European Central Bank) did indeed lead to inflation – to the inflation of securities prices in the financial markets. Thus, the inflated financial sector so frequently demonized by the Keynesians – the basis of the global debt dynamics that act as an economic engine – was the decisive factor in preventing a period of stagflation, such as the one that broke the back of Keynesianism in the 1970s and opened the way for neoliberalism. Neoliberalism unleashed the financial sphere precisely in response to the crisis phase of stagflation, which, as a form of crisis postponement, led to the formation of a zombie capitalism that ran on credit and lurched from bubble to bubble.[17]

The Return of the Deflationary Past

Capital thus loses its own substance, value-creating labor, in commodity production, which drives policymakers, confronted with ever greater mountains of debt, into a dead end: Inflation or deflation? In concrete terms, the aporia of capitalist crisis policy resulting from the inner barrier of capital is illustrated by the dreary dispute between supply-oriented neoliberals and demand-oriented Keynesians over the priorities of economic policy, which has been going on for years.[18] Twitter Keynesian Maurice Höfgen likes to practice this mindless shadowboxing.[19] It's always the same refrain, reeled off in a thousand variations: The neoliberal warning of over-indebtedness and inflation in the case of economic stimulus programs is countered by the Keynesians with the warning of the deflationary downward spiral triggered by austerity programs. Both sides are correct in their diagnoses, which were only obscured by the financial bubble economics of the neoliberal era. Now, in the era of stagflation, it is becoming clear that it is precisely the monetary policy of central banks that is in a crisis trap.[20] Central banks would have to raise interest rates for the sake of inflation, and at the same time lower interest rates to prevent a recession.Incidentally, the historical period of stagflation in the 1970s outlined above – to which the late capitalist world system is currently returning at a much higher level of crisis– was the point at which Keynesianism actually failed brilliantly.[21] After the end of the great post-war boom, which was fueled by the Fordist accumulation regime, all Keynesian policy prescriptions failed. Thus, neoliberalism was able to prevail in the 1980s only because Keynesianism failed spectacularly –with double-digit inflation rates, frequent recessions, and mass unemployment. When a has-been Keynesian like Heiner Flassbeck claims – true to style in the Querfront magazine Telepolis[22] – that it was only the energy and oil price crisis that triggered the rise in inflation then as now, he is lying to himself. Despite all the economic stimulus programs, Keynesianism was not able to create a new regime of accumulation – and it will not be able to conjure up new markets that could valorize masses of wage labor at the current global level of productivity.

Neoliberalism “solved” the problem through the speculative expansion of the financial sphere, the financialization of capitalism, i.e. through the postponement of crisis within the framework of a veritable financial bubble economy, which allowed capital to live a kind of zombie life on credit for three decades. This is also the fundamental difference between the stagflation of the 1970s and the current phase of stagflation. The level of crisis is much higher – and this can easily be seen from the ratio of total debt to economic output, which has risen from around 110 percent at the beginning of the neoliberal era in 1980 to 256 percent today (excluding the financial sector).[23]

And a sustainable reduction of this mountain of debt is possible only at the price of a recession – in other words, not at all in the long run. Quite apart from the fact that responding to recessions with Keynesian stimulus programs is ecological madness. The recessions of 2009 and 2020, which erupted in the wake of the crisis surges of the time, resulted in the only years in the 21st century in which CO2 emissions declined. But the stimulus packages described above led to the highest emissions increases of the century in the years that followed. In 2009, greenhouse gas emissions fell by 1.4 percent,[24] only to rise by 5.9 percent in 2010 thanks to Keynesian stimulus programs![25]In 2020, emissions fell again by 4.4 percent due to the pandemic, while in 2021 they increased by 5.3 percent due to multiple stimulus packages.[26] Destitution in recession or climate death? This is the expression of the ecological aporia of capitalist crisis policy.

Ideological Material for Leftist Crisis Opportunism

Obdurate old Keynesians like Flassbeck, as well as the completely crazy new generation around MMT, stubbornly ignore these simple connections, which point quite clearly to the necessity of system transformation. They still promote the fairy tale that the wrong policies led to financialization, to the expansion of the financial markets in the neoliberal era – and that the only thing to do is to “contain” them. And, of course, they routinely repeat their tired routine of warning against restrictive monetary policy despite double-digit inflation. But the acrobatics with which the evidence of the crisis trap of bourgeois policies is denied in order to repeatedly dismiss inflation as an “anomaly” to be fought with “real” Keynesian policies are becoming downright embarrassing. In Keynesianism, which is rapidly turning into regression, there is simply no sense of shame, even when one's own predictions are so clearly embarrassed by the reality of the crisis, as in the current phase of stagflation.In Flassbeck, the notorious Höfgen, and in many other Keyensians who are absolutely blind to the world crisis of capital, there is a reflex to deny all evidence of the ideological impasse in which they find themselves. Just as inflation is not “real” inflation, they call for the “real” Keynes in crisis policy, since everything that has been used so far in terms of methods does not correspond to the ideal. In all depressing frankness, this is evident in the author of the above-mentioned book on central bank capitalism, who describes at length how central banks have to prop up the bloated financial system, only to claim that this is not Keynesianism because financial markets are not restrained:[27] “So the current heavy intervention by central banks in the financial system and even the support measures taken by governments during the Covid pandemic are not a return to the strong state or a new Keynesianism. Despite the severity of the crises, there have been no far-reaching changes in the course of economic and fiscal policy. It is a way of governing that takes place within the market-liberal economic order that continues to prevail. Neither the functioning of the financial system in general nor that of the shadow banking system in particular is being questioned. But that is exactly what would have to happen to overcome the system's inherent tendencies toward crisis.”

In fact, today's crisis Keynesianism cannot live up to the old ideal because, as a form of precarious crisis management, it is confronted with the consequences of the decade-long financialization of capitalism. It is depressing: Joscha Wullweber describes the consequences of this financialization on the basis of what he calls the “shadow banking system” of repo transactions[28] and laments the consequences of the rapid expansion of the financial sphere, only to remain in the capitalist thought-prison and declare the structural dynamics a mere question of a wrong policy. And it is precisely this way of thinking that makes Keynesianism an easy ideological vehicle for left opportunism.[29]The Keynesians are courted by the “Left Party” because they reduce the systemic crisis to a mere question of policy, which legitimizes the deliberate complicity in crisis management of entire Left Party rackets, from left-liberal to right-nationalist. The Keynesian critique of capitalism has long since coagulated into an ideology.

Post Keynesian War Economy

Keynesianism, with its drab deficit spending and its love for the state, cannot, of course, solve the deepening internal and external crisis of capital, but it can function as a transition to a new quality of crisis. Keynes can provide a useful bootloader, a transitional vehicle, to a qualitatively new form of authoritarian crisis management, especially for functional elites who often act “on sight.” Ideologically advanced post-Keynesians, such as the Taz editor Ulrike Herrmann, have long understood this:[30] In her recent book on the “end of capitalism,” she combines an account of the external limit of capital largely cribbed from the critique of value with a commitment to the war economy – including ukase (decree, Russian) and rationing. The Taz editor wants to endow the German state, which is blind in its right eye and riddled with right-wing cronies, with immense power and make it the central agent of social reproduction in the crisis. Here too, of course, Ms. Herrmann is building on a Keynesian critique of capitalism in which the state appears as the great antagonist of capital – and not as part of the capitalist system that is going down with it, as is already the case in a number of “failed states” on the periphery.This, authoritarian, post-democratic crisis management, carried out by eroding, sometimes openly savage state apparatuses, is what the course of the crisis boils down to. The Keynesians play only the – stupid or perfidious – cheerleaders of this objective crisis tendency towards anomic authoritarianism. Keynesianism, which is only considered to be to the left of social democracy because of the absurd rightward shift of the entire political spectrum, thus degenerates here, too, into ideology in the purest sense: to justify the threatening authoritarian state-capitalist crisis administration, which would be the exact opposite of the emancipation from the collapsing late-capitalist objective coercion regime, an emancipation that is necessary for the survival of humanity. Consequently, the left should finally come to see the Keynesians for what they objectively are: ideologues.